Economy

Tax rates for the year 2025

Income tax rate 8.7 %

Property tax rates

- general property tax rate 1.10 (building)

- land property tax rate 1.30

- tax rate for permanent residential buildings 0.50

- tax rate for other residential buildings 1.50

- property tax rate for non-profit organizations 0.00

- tax rate for undeveloped building lots 4.00

- tax rate for power plants 1.50

Budget

The council must approve a budget for the municipality for the next calendar year by the end of the year, which defines the operational and financial objectives of the municipality.

In conjunction with the approval of the budget, the council must also approve a financial plan for three or more years (planning period). The budget year is the first year of the financial plan. Thus, the budget and the financial plan present the objectives for the development of municipal services and explain how services and investments will be funded.

The implementation of the budget in accordance with the set objectives is monitored and reported periodically to the council and other bodies.

Budgets

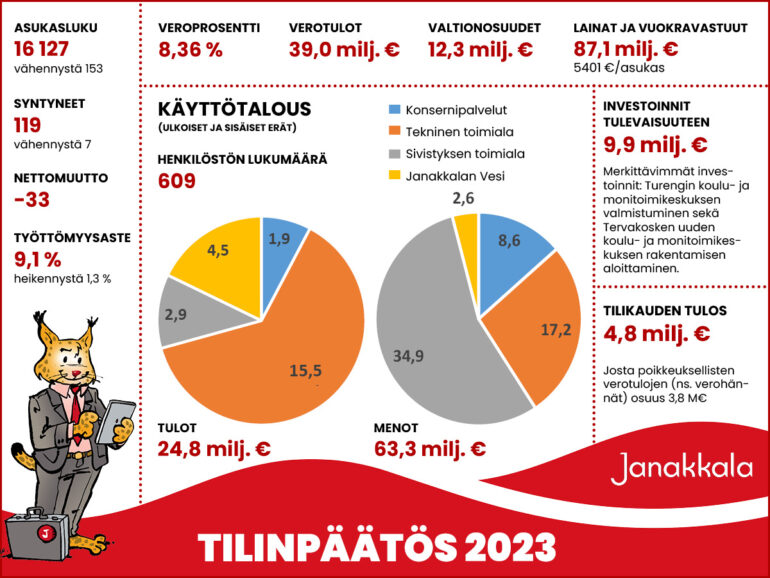

Financial statements

The financial statement is a calculation made for the financial year, which clarifies the municipality’s result and financial position. The financial statement also includes, among other things, an operational report, which states the achievement of the operational and financial objectives approved by the municipal council in the budget and describes the development of the municipality’s activities.

The municipal financial year is the calendar year. The municipal board must prepare the financial statement for the financial year by the end of March of the following year and submit it for auditing by the auditors. The auditors must examine the financial statement by the end of May. The municipal board must present the financial statement to the council after the audit.

The municipal council decides on the acceptance of the financial statement and the granting of discharge from liability after receiving the auditors’ audit report and the evaluation report from the audit committee. The council must deal with the financial statement by the end of June.

Financial statements

- Financial statement 2023 (Approved by the municipal board)

- Financial statement 2022

- Financial statement 2021

- Financial statement 2020

- Financial statement 2019

- Financial statement 2018

- Financial statement 2017